Unmapped Accounts: The $50K Surprise Hiding in Your P&L

Quick test: Pull up your management P&L. Note total operating expenses.

Now pull up your trial balance. Sum all expense accounts.

Do the numbers match?

If they don't, you have unmapped accounts. And those unmapped accounts are hiding real expenses from your reports.

The Invisible Problem

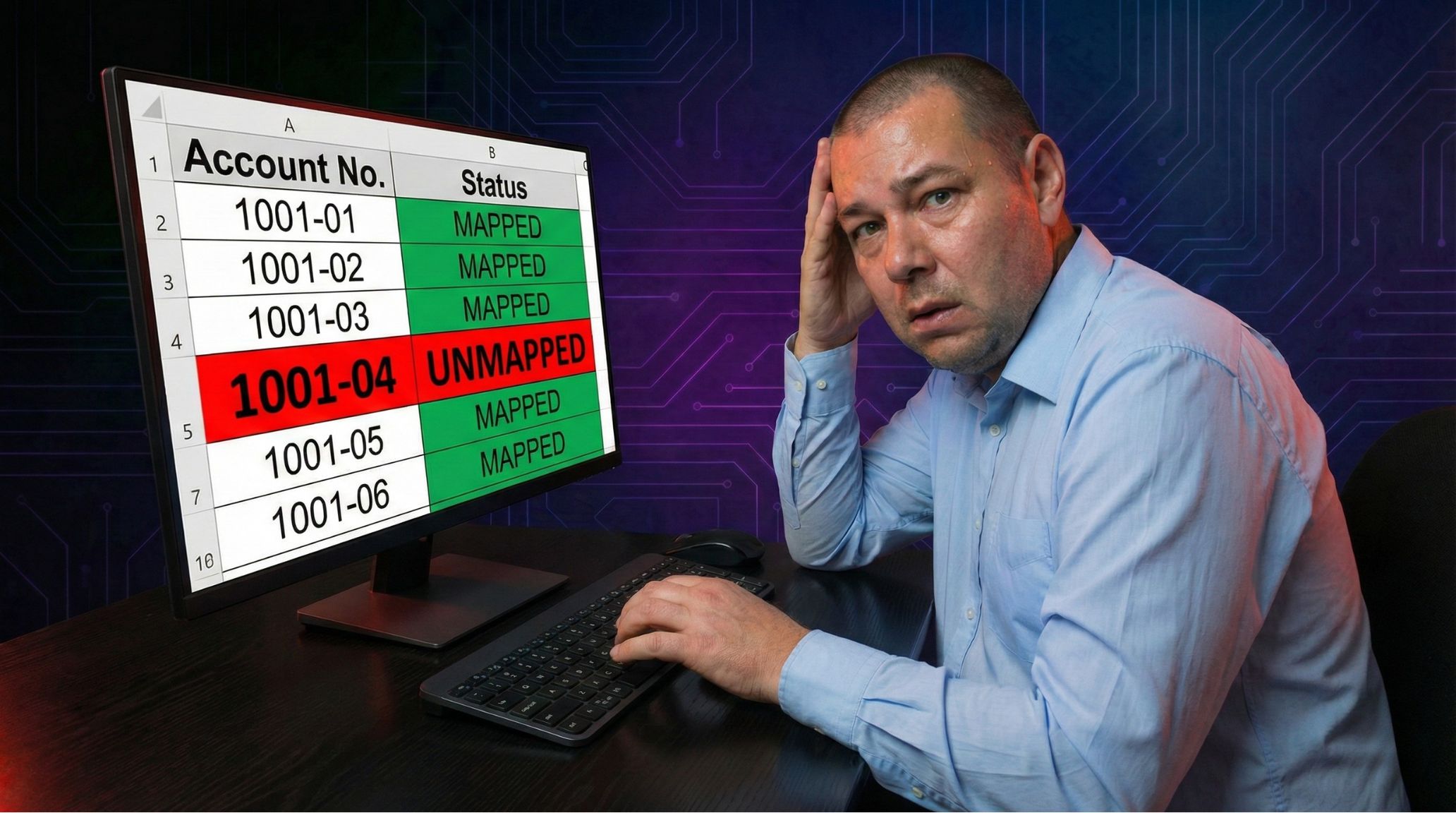

Unmapped accounts are accounts that exist in your GL but aren't connected to your reporting structure. They have balances. They represent real transactions. They just... don't appear in reports.

This isn't a bug in your system. It's a feature gap.

ERPs don't know about your reporting hierarchy. They track accounts. Your reporting template consumes those accounts through mappings—lookup tables that translate account numbers into report lines.

When a new account gets created and nobody updates the mapping, that account becomes invisible. Its balance exists. It just doesn't roll up anywhere.

How $50K Disappears

Here's a typical scenario:

- Your company hires a new vendor for specialized consulting

- Accounting creates a new GL account: 6025 - Professional Services - Consulting

- The vendor invoices $50K over three months

- Nobody tells the reporting team about the new account

- Your P&L shows Professional Services from accounts 6020, 6021, 6022, 6023, and 6024

- Account 6025 sits unmapped

Your P&L is now understating Professional Services by $50K. And you don't know it.

The Compounding Effect

One unmapped account is a problem. Multiple unmapped accounts are a crisis.

Every new account is an opportunity for a mapping gap. New cost centers, new departments, new vendors, new projects—each creates GL accounts that need mappings.

In a typical mid-size company, 5-10 new accounts are created monthly. If even 10% slip through unmapped, you're accumulating invisible balances continuously.

After a year, the gap between your GL and your reports can be substantial.

Why Detection is Difficult

The challenge with unmapped accounts is that reports look complete. All the numbers are there. All the categories are populated. Nothing is obviously missing.

You can't see what you're not reporting.

Most teams discover unmapped accounts accidentally:

- An auditor notices the discrepancy

- A board member asks about a specific expense that doesn't appear

- Someone manually reconciles to the TB and finds a gap

By then, you've been reporting incorrect numbers for months.

The Reconciliation Habit

The only reliable way to catch unmapped accounts is routine reconciliation. Every reporting cycle, compare:

Report totals vs. GL totals: Your reported revenue should equal GL revenue. Your reported OpEx should equal GL OpEx. Gaps indicate unmapped accounts.

Active accounts vs. mapped accounts: Export every account with a non-zero balance. Compare against your mapping table. Every active account should have a destination.

This takes time. Most teams don't do it because close is already rushed.

But the alternative—presenting incomplete financials to your board—is worse.

Building in the Safety Net

The better approach is systematizing detection:

Automated alerts: When a new GL account is created, trigger a notification to the reporting team. Don't rely on memory.

Pre-publish checks: Before any report is finalized, run an automated comparison of report totals to GL totals. Flag discrepancies.

Mapping workflows: Make mapping a required step in account creation. New account + no mapping = blocked.

These controls shift detection from "hope someone catches it" to "system prevents it."

The Trust Calculation

Here's the real cost of unmapped accounts: trust.

When you discover a $50K gap, you have to explain it. To your CFO. To your board. To your auditors.

"We were missing expenses because an account wasn't mapped" is not a confidence-inspiring explanation.

And once you've had one mapping gap, people wonder about others. Every future report carries an asterisk of doubt.

Your Action Step

Right now, run the reconciliation. Total your management P&L. Total your GL expense accounts. Do they match?

If yes, congratulations—your mappings are complete (for now).

If no, you've found money hiding in your system. Real expenses that aren't being reported.

That $50K surprise isn't a future risk. It might be your current reality.

Find it before someone else does.