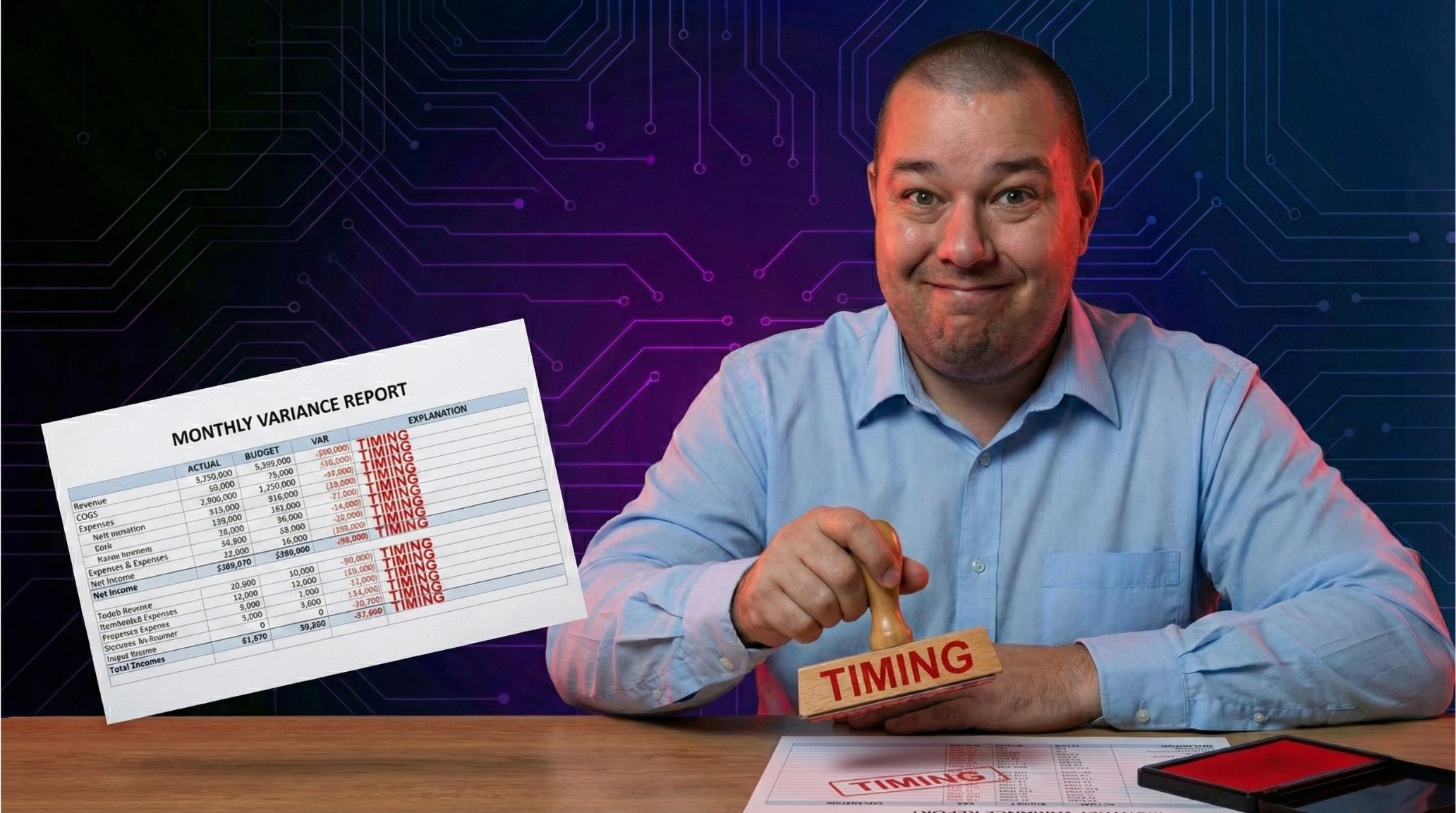

Stop Explaining Variances with 'Timing Differences' (And Other Lies We Tell the Board)

Open any board deck in America and you'll find it: the phrase that explains everything and nothing.

"Variance due to timing differences."

It's the finance equivalent of "it's not you, it's me." Technically true. Functionally meaningless.

The Timing Trap

"Timing differences" has become the default explanation for any variance we don't have time to investigate. It's safe. It's vague. It implies the variance will resolve itself.

Sometimes it's even accurate.

But when every variance explanation is timing, you're not providing analysis—you're providing cover. And your board knows it.

Why We Default to Timing

The timing excuse persists because:

Time pressure: You have 48 hours between close and board deck. Deep variance analysis doesn't fit that window.

Tool limitations: Your spreadsheet shows that marketing is $15K over budget. It doesn't show that $12K is the conference you approved and $3K is a coding error.

Commentary fatigue: Writing the same explanation twelve months a year is exhausting. "Timing" is efficient.

Fear of being wrong: Specific explanations can be challenged. Vague ones can't.

What Good Variance Commentary Looks Like

Good commentary answers three questions:

- What changed? (The number)

- Why did it change? (The driver)

- Should we care? (The implication)

Compare these two explanations:

Bad: "Marketing $15K unfavorable due to timing."

Good: "Marketing $15K unfavorable: $12K from Q2 conference (approved, expected to reverse in July) + $3K from duplicate vendor payment (investigating, will recover)."

The second takes more effort. It also provides actual information.

The Elevator Test

Here's a useful filter: Could you explain this variance in an elevator ride?

If your explanation requires the caveat "it's complicated," you haven't done the analysis. If you can say "we overspent on the conference but we'll true it up next month," you have.

Board members don't need accounting nuance. They need to understand what happened and whether it matters.

Building a Variance Culture

Moving beyond timing excuses requires:

Better tools: Variance analysis needs to show the components of change, not just the total. Waterfall charts that decompose variances into drivers make this visual.

Time allocation: Budget actual hours for variance investigation, not just variance calculation.

Accountability: Track how often "timing" appears in your commentary. If it's more than 20%, you're probably not analyzing.

Templates: Create commentary templates that force specificity. "Variance driven by [DRIVER] with expected resolution [DATE/NEVER]."

The Trust Dividend

When you stop hand-waving variances, something interesting happens: your board starts trusting your numbers more.

Not because the numbers are better—but because your explanations demonstrate that you understand them. Confidence comes from competence, and competence is visible in specificity.

The CFO who says "timing differences" sounds like they're guessing. The CFO who says "the AWS bill hit early this month, we'll see the offset in October" sounds like they're in control.

Your Challenge

Pull up your last board deck. Count the variance explanations that say "timing" or its cousins ("phasing," "accrual," "catch-up").

If that number is high, you have work to do. Not because your board is complaining—but because you deserve better explanations than the ones you're giving.

"Timing differences" is the easy answer. It's rarely the right one.