Mapping Maintenance: The Silent Killer of Trust in Financial Reports

Your controller created a new GL account last Tuesday. It made sense—the business needed to track a new expense category separately.

Three weeks later, you present a board deck showing OpEx down 8% versus budget.

The board is thrilled. You're a hero.

Except OpEx isn't down. That new account just isn't mapped to your reporting hierarchy. You're missing $47,000 in expenses, and no one knows it.

The Mapping Problem

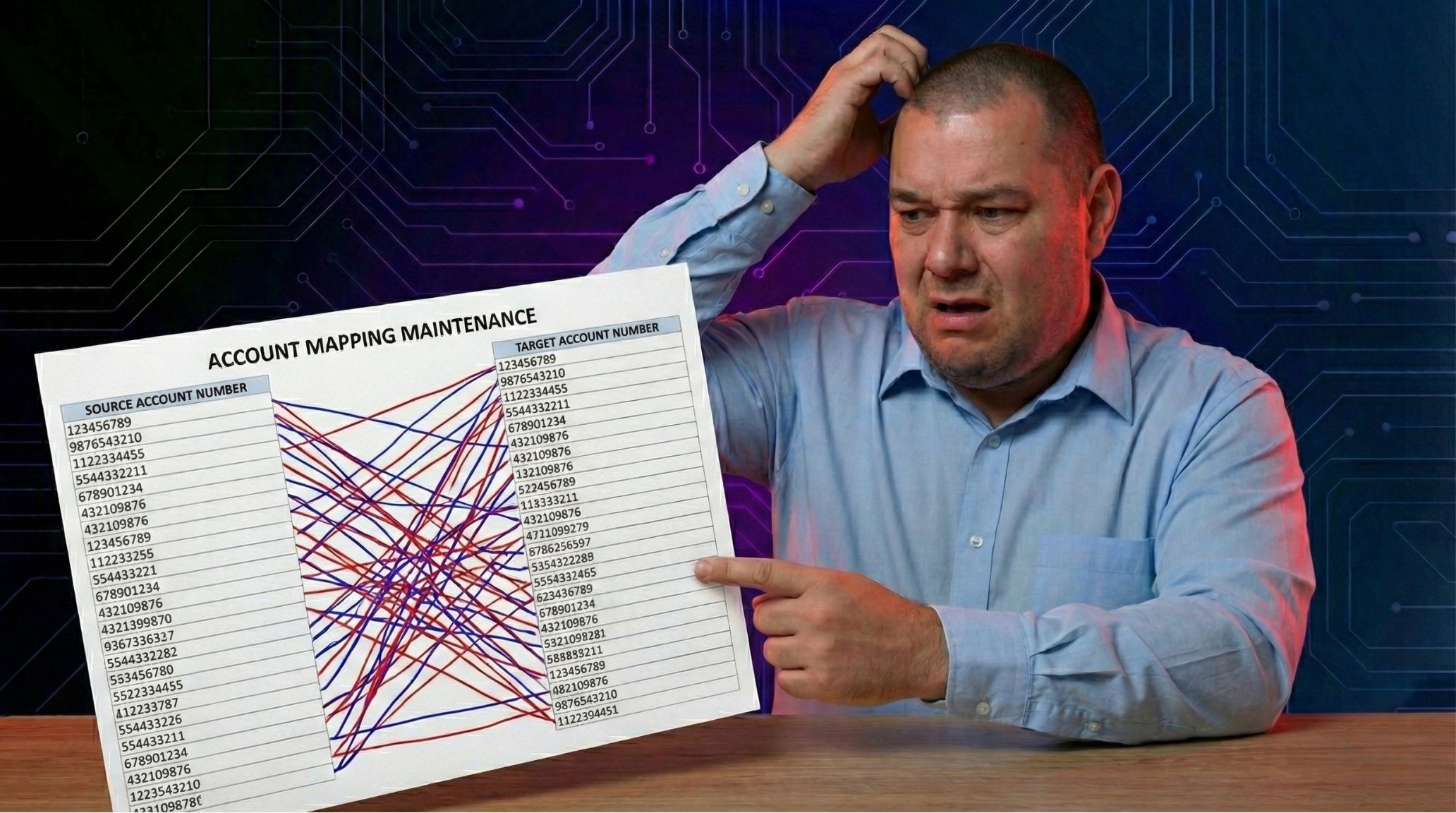

Every financial report relies on mappings: the invisible layer that connects raw GL accounts to the categories your stakeholders understand.

ERP systems track thousands of accounts. Board decks show dozens of line items. The mapping is what translates between them.

And mappings break constantly.

Why Mappings Fail

New accounts: Every new GL account needs a mapping destination. If your reporting system doesn't know about the account, it doesn't include the balance.

Reorganizations: When you restructure departments or cost centers, every affected account needs remapping. Miss one, and that balance disappears.

Acquisitions: Integrating a new entity's chart of accounts is mapping chaos. Different numbering schemes, different category definitions, different everything.

Human error: Someone types "6010" instead of "6100" and suddenly legal fees are in marketing.

The Trust Cascade

The real damage from unmapped accounts isn't the initial error—it's what happens next.

You present incorrect numbers. Someone catches them. You send a correction. Your credibility takes a hit.

Next month, a board member asks: "Are you sure about these numbers?" You say yes, but the question reveals the doubt.

The quarter after that, they start asking for more detail, more backup, more validation. Not because they're thorough—because they don't trust your reports.

One unmapped account created a trust deficit that takes months to rebuild.

Detection is Hard

The insidious thing about unmapped accounts is that they're invisible by design. A report that's missing data looks exactly like a report that's complete. The totals still sum. The variances still calculate. Everything looks right.

Unless you're actively checking for unmapped accounts, you'll never know they exist.

Most teams don't check. They assume the mapping is complete because it was complete last month. They trust the process.

The process isn't trustworthy.

Building a Mapping Safety Net

Protecting against unmapped accounts requires:

Active monitoring: Every reporting cycle should include a check for GL accounts with balances that aren't mapped to any reporting line. This isn't optional.

New account workflows: When someone creates a GL account, the reporting team should be notified. "Created" and "mapped" should happen together.

Completeness checks: Total assets per your report should equal total assets per your GL. If they don't, something is unmapped.

Account audits: Periodically review your full account list against your mapping table. Gaps should be investigated, not assumed.

The Tool Gap

Here's the uncomfortable truth: most reporting tools don't help with this. They consume mapped data and produce reports. If something isn't mapped, it's someone else's problem.

Purpose-built reporting layers include mapping management as a core function. They alert when new accounts appear. They flag accounts with balances but no mapping. They make the invisible visible.

If your current tool doesn't do this, you're relying on human vigilance. And human vigilance fails.

Your Action Item

This week, run a simple check: export every GL account with a non-zero balance. Compare that list to your reporting mappings.

If every account is mapped, congratulations—you're in better shape than most.

If you find orphans, you've discovered the silent killer. Now you can do something about it.

That unmapped account isn't just a data problem. It's a trust problem waiting to happen.